Whether your funds are meager or abundant, it’s no easy task to plan your financial future. So it comes as a relief to must that the best financial planners in Toronto can help you meet your long-term financial goals.

If robo-advisors just don’t cut it for you right now, you can always get personalized, holistic advice from any of the firms we’ll list below. Let’s check them out.

- How Much Do Financial Planners Cost in Toronto?

- The Best Financial Planners in Toronto

- 1. Objective Financial Partners

- 2. Frontwater Capital Inc.

- 3. Bilyk Financial

- 4. BlueAlpha Wealth

- 5. Buxton Financial For Retirement

- 6. Kurt Rosentreter Financial Advisor and Wealth Management

- 7. Caring for Clients

- 8. Edward Jones – Financial Advisor: Ryan M. Henderson

- 9. Rosedale Family Office

- 10. Kismet Wealth Group Corp.

- 11. Parkhouse Financial

- 12. Kind Wealth

- How to Choose the Right Financial Planner

- FAQs about Financial Planners

How Much Do Financial Planners Cost in Toronto?

Before we get to the planners, let’s stay with how much they cost in Toronto.

Financial planners get paid in two ways: by a flat (hourly or annual) fee or based on how much money they manage for you.

Hourly fees range from $200-$400, while flat annual fees (called retainers) range from $2,000-$7,500.

Payments based on your assets are usually around 1% for in-person financial planning, but that percentage drops as your funds go up.

Online financial planning services are usually more affordable at 0.30%-0.89% or a flat annual fee that starts somewhere around the $400 mark.

The Best Financial Planners in Toronto

The figures given in the previous section are estimates based on the average. There can be large disparities in costs based on the range of services a financial planner can provide.

It’s really just a matter of checking to see what you can afford and what you think is a fair return for your money. To that end, our notes on each planner may help!

1. Objective Financial Partners

| SERVICES | Fee-Only, Advice-Only Financial Planning, Retirement Planning, Canadian Expat Planning, Investment Planning, Self-Directed Planning, Executor/Probate/Estate Services, Tax Planning & Preparation, Money Coaching, Financial Planning, Outsourced Planning |

| WEBSITE | https://objectivefinancialpartners.com |

| ADDRESS | East Tower, 675 Cochrane Dr 6th floor, Markham, ON L3R 0B8, Canada |

| CONTACT DETAILS | +1 416-691-8471 |

| OPERATING HOURS | Monday – Friday: 9 AM – 5 PM |

Objective Financial Partners has been delivering flat-fee and hourly fee-only, advice-only financial planning services since 2012. Their core mission is to provide unbiased and objective financial, tax, and estate planning advice, with a particular emphasis on retirement planning. By focusing solely on offering advice without selling any products or receiving referral fees from third parties, they ensure that their recommendations are completely impartial and tailored to the client’s needs.

One significant advantage of working with Objective Financial Partners is their commitment to unbiased advice. Their fee-only model guarantees that the financial guidance provided is entirely in the client’s best interest, free from any conflicts of interest associated with product sales or third-party referrals. Additionally, their comprehensive range of services includes not only retirement planning but also income tax preparation, which covers personal, corporate, and trust tax returns, making them a one-stop solution for many financial needs.

Another notable benefit is their flexibility and accessibility. Objective Financial Partners offers remote consultations via secure web conferences and email, allowing them to serve clients across Canada and internationally. This broad reach ensures that even clients outside Southern Ontario can access their expert financial planning services without geographical constraints.

However, the cost of their services may be a consideration for some clients. Their fee structure, which includes flat project fees or hourly rates, can be relatively high, particularly for comprehensive financial plans. While the thoroughness and expertise provided justify the expense for many, those with more limited budgets might find the costs prohibitive.

In conclusion, Objective Financial Partners stands out for its dedication to providing objective, unbiased financial planning advice and its comprehensive service offerings. Their emphasis on impartiality and the ability to work with clients globally enhances their appeal, though the associated costs should be carefully considered. Overall, their professional approach and extensive expertise make them a valuable choice for those seeking detailed financial planning.

Pros

- Unbiased, fee-only financial advice

- Comprehensive range of financial planning services

- Remote consultations available

- Expert in retirement planning and tax preparation

Cons

- Higher service fees

Customer Reviews

Here are some reviews from their clients:

“I greatly enjoy working with Nancy Grouni. She gives very sound advice and I feel confident that my financial health is in good form. I spend enough time at work, so it’s very reassuring to know that Nancy keeps my financial goals on track without me having to dump lots of time into it. I still do my own investing, but Nancy is happy to ensure I’m making good decisions and I’m happy that she doesn’t sell anything. Fee based financial planners are the way to go!”

“After procrastinating on the need for expert, independent financial advice for a few years, we finally contacted Nancy Grouni of Objective Financial Partners. It was a great decision and one that should have been made sooner. It is already clear that Nancy’s work will pay for itself several times over, not to mention the peace of mind that comes from having a predictable plan to meet all of our retirement goals. On top of that, Nancy is an absolute pleasure to work with.”

2. Frontwater Capital Inc.

| SERVICES | Financial planning, retirement planning, estate planning, divorce planning, investments (RRSPs, TFSAs, RRIFs), GICs, business advice, personal and corporations. |

| WEBSITE | https://www.frontwater.ca/ |

| ADDRESS | 1920 Yonge Street, Suite #200 Toronto Ontario M4S 3E2 |

| CONTACT DETAILS | Phone: 416-903-9195 E-Mail: [email protected] |

| OPERATING HOURS |

Founded by Jeff Kaminker in 2007, Frontwater Capital is an independent wealth management firm that has looked after a number of affluent and high net worth families since its inception. In 2016, Frontwater expanded beyond its close-knit client base and welcomed new clients to the fold.

It is consistently recognized as one of Toronto’s top financial planning and investment firm. The company enjoys an immense sense of pride in working with successful professionals, corporate executives, and business owners to help them achieve their long-

term financial goals.

Their holistic approach, excellent boutique experience, and team of highly qualified individuals is what makes them different. Plus, they analyze risks along with your lifestyle goals to create a tailored financial plan for your situation.

In addition to financial planning, their team of experts guide clients through everything from investments and estate planning to tax planning to insurance solutions.

No matter your goals, no matter your stage in life, their attention is on you. Their advice is also independent and free of the “conflicts of interests” that you often see with large financial institutions.

Pros

- Highly reputable company

- Has a team of CFAs

- 20+ years of experience

- Comprehensive planning services for both individuals and families

- Personalized Services

Cons

- Can get pricey

Customer Reviews

Here’s what some people have to say about them:

“We have been clients of Frontwater Capital for more than 12 years now. Jeff Kaminker and his team have surpassed our expectations in almost every way. He takes the time to really know his clients and gives us confidence that our financial goals are well understood. We also really appreciate that Jeff is a fee-only investment advisor. We feel very secure knowing that Jeff is in our corner.” – Bernard Chan, CEO and Jennifer Chan, Associate Director

“I would like to say how pleased I have been with the service that Frontwater Capital has been providing over the last several years. Jeff Kaminker has been responsible for taking care of my investment and personal pension portfolios and has done so with great skill and care and, with excellent results. I certainly recommend his professional services to anyone looking for sound independent financial advice.” -S Brown, CEO Genuine Health

3. Bilyk Financial

| SERVICES | Summary of services, investment management, insurance, legacy planning, risk management, tax planning, and group benefits. |

| WEBSITE | https://bilykfinancial.com/ |

| ADDRESS | 4769 50 Ave, Vegreville, AB T9C 1L1, Canada |

| CONTACT DETAILS | [email protected] 780-632-6770 |

| OPERATING HOURS | Monday – Friday, 9:00 AM – 5 PM |

Bilyk Financial is known for their long-lasting customer relations and tailored services. They’re one of the best financial planners in Toronto, boasting a 99% client retention rate and more than five decades of experience in the industry.

One of the best things about them is that you’re guaranteed to see results when you invest with them. After all, they’re partnered with Aligned Capital Partners and backed by the National Bank Independent Network (NBIN).

Another thing we loved about Bilyk Financial is their process-oriented approach, which enables them to yield consistent results for their clients. They can even help you develop a tax strategy that works well with your financial plans and goals.

Bilyk Financial operates an institutional-grade investment management approach that they customize precisely to your situation. Most advisors start with an allocation to different asset classes and then fill the “buckets” with specific investments. They go the other way: they start with a universe of strategies, analyze each on the basis of returns, volatility, and correlations, and then build a portfolio that combines them in a way that they believe will best meet their clients’ objectives.

In practice, that means going outside the traditional stocks-bonds paradigm and into alternatives, which can be especially useful for generating income in the current environment. Each portfolio will include exposure to different investment solutions, including public equities, private equities, fixed-income, private real estate, private infrastructure, private credit, and commodities.

They believe that they can provide investors with above-average, long-term, risk-adjusted returns by consistently following their investment philosophy and process.

Overall though, we highly recommend Bilyk Financial. They’re very transparent about the fees they collect, and they have a lot of long-term satisfied clients, which proves the excellent quality of services they provide.

Pros

- Process-oriented approach

- 50 years of experience

- Offers free financial consultation

Cons

- Requires a call or appointment for more information

Customer Reviews

They provide professional advice and service

“I have been a client of Adam and Joe for over 12 years. It has been a very positive relationship from day one. They provide professional advice and service and are always available to answer questions or address any concerns I may have. Looking forward to the next 12 years!” – Darryl Vinet

Impressed with their customer service, responsiveness, and positive approach

“We have dealt with Adam and Joe for several years and have always been impressed with their customer service, responsiveness, and positive approach to managing our investments. They definitely stand out amongst financial advisors in our view.” – Mark Corkery

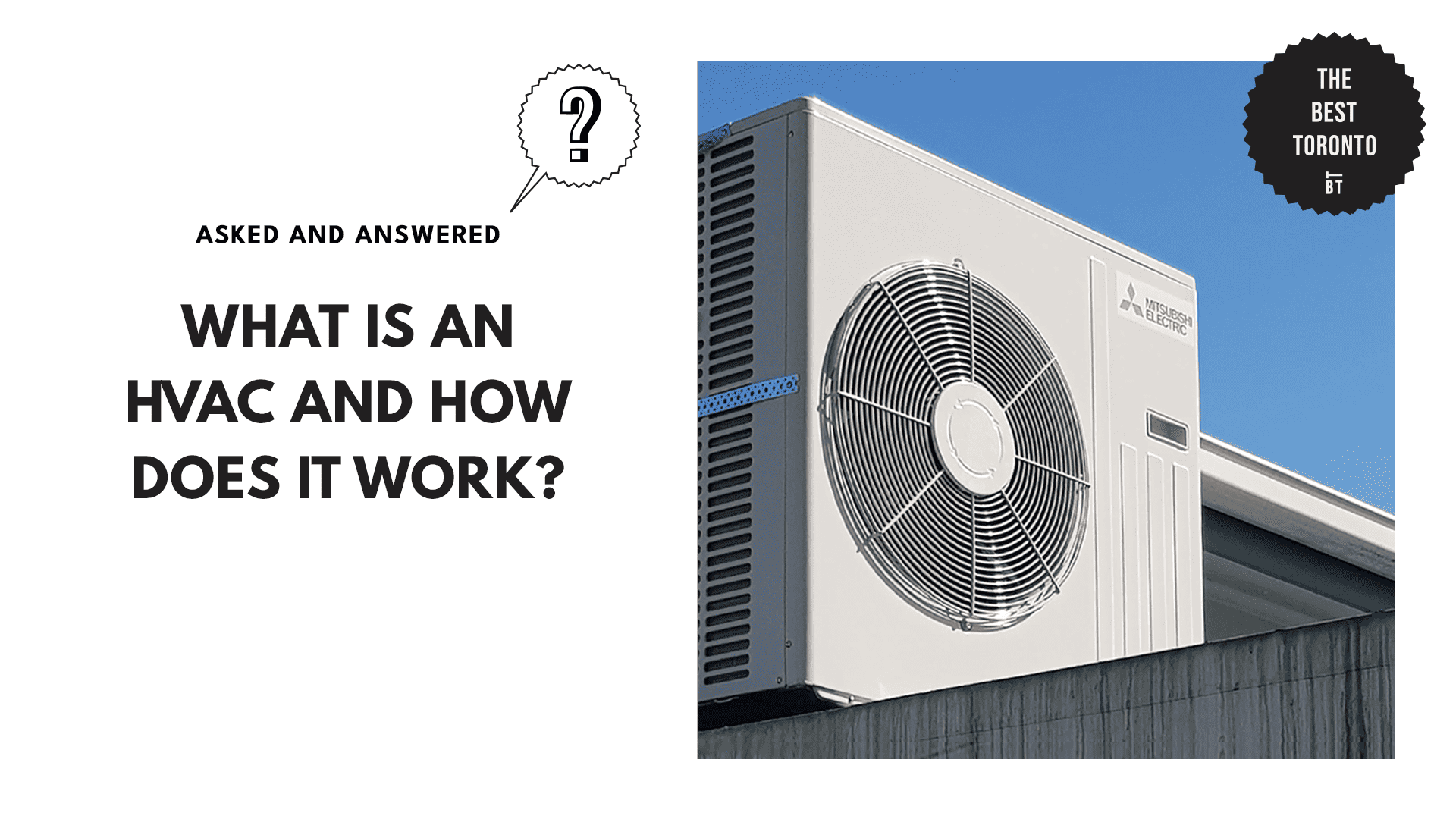

4. BlueAlpha Wealth

| SERVICES | Financial Needs Analysis Retirement Planning Group Benefits and Group RRSP for employees Investment Management Business Owner financial needs analysis and planning. Disability Insurance Life Insurance |

| WEBSITE | https://bluealphawealth.ca |

| ADDRESS | 101 Duncan Mill Rd, Suite 108, Toronto, ON, M3B 1Z3 |

| CONTACT DETAILS | (416)966-0606 1-877-494-0701 (Toll-Free) [email protected] |

| OPERATING HOURS | Monday – Friday 9 am to 6 pm; Saturdays by appointment; Virtual meetings available |

BlueAlpha Wealth is a Toronto-based financial advisory firm that aims to help individuals know where they stand today by understanding how best to manage their cash flow whilst having an eye for future retirement income needs and planning for potential health risks.

Carter Njovana is the main financial advisor with 17 years of experience in financial markets, wealth management, and life and disability insurance planning. From what we understand and read from reviews, Carter is someone who is easy to talk to and meets individuals where they are so they can feel secure and in control of their situation as he emphasizes clarity and education.

As the website and client testimonials state, they work with clients from different fields and all walks of life from people starting out to executives and business owners with complex financial needs planning. So long as you’re serious about managing your finances and saving long-term, they’ll readily provide their services.

BlueAlpha Wealth offers a wide range of services that include helping you understand how best to manage your cash flow and ensuring that you identify any gaps, vulnerabilities, and opportunities in your investments and general planning.

If you’re from outside of Toronto or go out of Toronto frequently, don’t fret. BlueAlpha Wealth accommodates clients regardless of their location, all you need to do is book a consultation over the phone, via their website calendar booking, or by email and go from there. As their motto goes “Advice is only as good as the person you ask”.

Pros

- Quick and easy booking process

- Wide range of financial services

- No cost for initial interview and discussion

- Serves clients outside of Toronto

Cons

- Small team

Customer Reviews

Check out these glowing Google reviews for financial advisor Carter Njovana and Blue Alpha Wealth:

“I’ve worked with Carter for a year now, and have been recommending him to friends and family all the way throughout. Very personable, non-judgmental, encouraging, proactive, and extremely knowledgeable. Carter has helped me to gain confidence in my ability to understand, control, and make decisions around money, and get excited to continue learning more in the future. I’m so grateful for his support, kindness, and generosity with his time and expertise. I truly appreciate every interaction we have, and take away so much from them (and they’re also fun) 🙂 Thank you infinitely, Carter!” – Valerie M. – Toronto

“Mr. Njovana is a conscientious advisor who works diligently for his clients and is highly knowledgeable in finance and investment. Never pushy, he advises with care and always gives room for a client’s personal goals and decisions. Above all else, Mr. Njovana is a person of integrity and honesty and is dedicated in caring for and meeting the needs of each and every individual, no matter how big or small their investments may be. I highly recommend his service!” – David Lee – North York

“Carter is very accommodating and resourceful. I would recommend him to anyone looking for insurance/investment. Keep up the great work Carter and keep safe!” – Marcello Petricca – Brampton

5. Buxton Financial For Retirement

| SERVICES | Fee-Only Financial Planning with Retirement Income Planning focus. Private corporate strategy, decumulation strategies, inheritance, pension decisions, divorce settlements, tax planning, risk management, investment planning, estate planning. |

| WEBSITE | https://www.buxtonfinancial.ca/# |

| ADDRESS | 150 King Street West Suite 232, Toronto ON M5H 1J9 |

| CONTACT DETAILS | (416) 628-4502 [email protected] |

| OPERATING HOURS | Monday to Thursday: 8:30am-6:00pm Friday: 8:30am – 5PM |

With over 20 years of experience, award-winning planner Marlene Buxton takes her passion for numbers, details, and documentation, and helps people plan for the retirement they want.

Buxton Financial For Retirement takes the approach that retirement needs to be designed to allow you to have choices in your life. They provide fee-only financial planning focused on retirement.

Fee-only financial planning is a great option for those seeking unbiased advice while planning for retirement.

Marlene Buxton, retirement income specialist, at Buxton Financial For Retirement is our top option for those close to or in retirement. The pricing is separate from the size of a client’s investment portfolio, so it’s great if you’re looking for a more economical option.

Marlene Buxton is upfront about her fees for financial planning on her website. The standard package is set at $4,995 which is the pricing usually for single people with a simpler situation and sometimes a couple.

For most couples who are planning retirement, the complex package is set at $6,595. If you have a private corporation, multiple rental properties, US taxes, or other complexities, you may be in the premier package pricing. The premier package is set at $7,995.

Of course, your needs will be taken into account during the initial consultation. What you require might not fit in these set packages, so she’s willing to provide customized pricing for unique financial situations.

What we like about Marlene is her exclusive focus on retirement, breaking it down into three stages: restart, relax, and reflect.

These correspond to early retirement, middle retirement, and late retirement, respectively. You can be set up to have the information needed to make all those important retirement decisions and to have peace of mind about the future.

We think that her fees are well worth not having to worry about the future and to know which actions to take. If you agree, then book a complimentary session with Marlene to see if she’s the right fit.

Pros

- Retirement focus

- Fixed fees only

- Highest score in CFP exam in 2015

- In person or remote meetings

Cons

- Sole CFP in the company

- May be hard to book a consultation with at times

Customer Reviews

Check out these glowing reviews left for Buxton Financial For Retirement:

“Buxton Financial created a Financial Plan responsive to our needs and mapped out a retirement framework well into the future. This plan will be the framework to guide our financial decisions with comfort and less stress.

Marlene was very thorough, provided excellent knowledge transfer, and helped us make several critical decisions for our finances.Thank you to Marlene!”

– Baldey Gary

“A good test of client satisfaction is a willingness to recommend the product or service. We’ve done just that with colleagues and have offered Marlene’s financial planning services to each of our three adult-age sons, who are already financially responsible. Marlene is really, really good at what she does.

She’s at ease with communicating and explaining. She knows her stuff and produces a very professional and well conceived, practical report. She makes a point of really understanding you, the client. She loves what she does and when you combine that with outstanding competency for a service that people need , you end up with a winning formula.”

– Richard Hamel

6. Kurt Rosentreter Financial Advisor and Wealth Management

| SERVICES | Financial planning, insurance planning, investment advisory, career transitioning planning, divorce financial planning |

| WEBSITE | https://kurtismycfo.com/ |

| ADDRESS | 3 Church St. #302, Toronto ON M5E 1M2 |

| CONTACT DETAILS | (416) 628-5761 ext. 0 |

| OPERATING HOURS | Monday to Friday: 8:30am-5:30pm |

Kurt Rosentreter, a CFP with an impressive list of credentials, leads a team of six other highly qualified financial planners. They’ve been serving regular folk and corporations, like the largest banks and insurance providers in the world for over 25 years.

Since you most likely fall in the first category, you might be thrilled to know that your first contact with Kurt and his team will be complimentary. They want to learn about you, your assets, and your goals to see if there’s a working relationship that can be formed there.

If you both think it’s the right fit, they will then manage your life insurance coverage and prepare a comprehensive retirement plan for you. If you’re heavily into investing, rest assured that Kurt and his team can also build a tax-smart, high-value, and risk-managed portfolio based on your risk profile.

We appreciate that they keep with the times and give their clients the freedom to choose how they want to communicate. You can set up a schedule for regular calls, online meetings, and emails, all of which can be done on your phone.

If you’re going into this worried about costs, Kurt’s firm is one of the few that offers multiple fee options. Since every financial situation is unique, they should have the right value proposition for you.

Pros

- Keeps plans up-to-date

- Has published books

- Works as personal CFO

Cons

- Higher rates than most

Customer Reviews

Kurt Rosentreter and his team is highly-rated, with a perfect 5-star rating on Google Reviews. Here are the most recent ones:

“I met Kurt about 10 years ago when he was teaching a financial course I was attending. I was extremely impressed by his wealth of knowledge and knew I wanted him to manage my portfolio.Today, I am still as impressed. Kurt and his team are extremely knowledgeable and professional. They continually evaluate my portfolio to ensure it is right for me. He has helped me develop a strong financial portfolio that I am very comfortable with.I would definitely recommend Kurt and his team to help you grow your portfolio.”

– Michele Guglielmi

“Kurt is practical, realistic, and tells you what you need to hear, not what you want to hear. He’s been my trusted advisor for 15 years. If you’re serious about wealth building (not getting rich quick), I’d highly recommend Kurt and his team.”

– Lawrence Mandel

7. Caring for Clients

| SERVICES | Hourly consultations, wealth management, financial plans for individuals, couples, and business owners |

| WEBSITE | https://www.caringforclients.com/ |

| ADDRESS | 69 Yonge Street 2nd Floor, Toronto ON M5E 1K3 |

| CONTACT DETAILS | (416) 363-8500 |

Caring for Clients was founded by Rona Birenbaum back in 2000. She now leads a team of six financial advisors, all with extensive experience in the corporate sector.

CFC is pretty transparent about their $300 hourly rate, which is on the pricier side. Hourly consultations are best for those who already have a financial plan.

It would be the advisor’s job to find any gaps or make changes to your plan based on your new goals. We advise you to make a list of specific questions to ask your CFC advisor so you get your money’s worth.

If you don’t have a financial plan yet, you can build one with a CFC advisor from scratch. The team has a specific focus on debt elimination, so that’s probably going to be addressed first.

If you establish a professional relationship with a CFC advisor over time, you can always opt for a comprehensive personal plan, which has advice integrated into it. This costs around $4,500, and that already includes wealth management, retirement planning, risk management, and more.

Pros

- Access to a team, instead of one advisor

- Transparent about rates

- Option to upgrade to financial planning

Cons

- Expensive

- Has to reach out to other professionals for areas beyond their expertise (medical, business, etc.)

Customer Reviews

Here are two of the more recent Google reviews for Caring for Clients:

“I had an excellent experience with Rona. I now understand some things that I didn’t understand before and have a new strategy in terms of investing. I was very impressed with the customer service experience and everyone was very pleasant. I thought it is also important to highlight that in an industry where everyone is trying to sell you their investments, it’s important to take advice from someone who doesn’t have bias towards a certain type of investment. I think this business serves an important function. I believe because Caring For Clients is not attached to a bank, they are not trying to sell you specific investments, so the information they provide is high quality.”

– Na Na

“I don’t know what we’d do without Rona and the rest of the Caring for Clients team. They have been our most trusted source of guidance and advice for all of our major financial decisions. We know that our financial wellbeing is Rona’s priority in working with us. As a bonus, her patience and guidance have allowed me to shift from being absolutely overwhelmed by all things financial (I’m talking nearly fetal position) to feeling that it’s not all that complicated after all. I still need her help, but she’s helped me understand that it’s not as scary as it seemed.”

– Dan Trommater

8. Edward Jones – Financial Advisor: Ryan M. Henderson

| SERVICES | Retirement income strategies, retirement saving strategies, estate & legacy strategies, intergenerational planning, socially conscious investing, charitable giving |

| WEBSITE | https://www.edwardjones.ca/ca-en/financial-advisor/ryan-henderson |

| ADDRESS | 150 York Street Suite 912, Toronto ON M5H 3S5 |

| CONTACT DETAILS | (416) 485-5484 |

| OPERATING HOURS | Monday to Friday: by appointment only (works evenings) |

Edward Jones is an investment company that gives clients access to hundreds of financial advisors. We combed through their Toronto charter and found that Ryan Henderson is the one who comes most highly recommended.

Ryan works with a wide variety of clients, from serious investors to retirees. He focuses on maximizing retirement income, so he can set you up for a comfortable and worry-free future.

He does have a team behind him, so he’s able to take on multiple accounts at once. Since he’s an expert on investment, he can teach you a lot about personal finance and how to put your savings to good use.

Ryan is known to be a patient educator, which is a mark of an excellent financial advisor. As for the cost of his services, Edward Jones generally features fee-based advisors with a starting fee of 0.09%, which is just around the cost of a fancy Robo-advisor.

If the primary area of your finances that you need help with is investment, we think you can’t go wrong with Ryan. He elicits trust and seems to have his clients’ best interest at heart, judging from what his customers say of him.

Pros

- Intergenerational planning

- Retirement focus

- CFP since 2009

Cons

- Sole CFP in team

- Ambiguous offerings

Customer Reviews

Check out these glowing Google reviews for Ryan M. Henderson:

“My husband and I were referred to Ryan by some friends a few years ago and we are very pleased with the level of service and the growth of our investments. He cares about what’s important to us and takes his time to explain everything. We definitely recommend Ryan to anyone looking for good investment advice.”

– M Graham

“I have been dealing with Ryan for many years now. He’s done very well for me financially and I trust him implicitly. He takes a personal interest in his clients and puts a lot of work into developing the best portfolio suited just for them and their needs. I would recommend Ryan highly to any friend or family with full confidence.”

– Barb

9. Rosedale Family Office

| SERVICES | Financial planning, business & family advisory, will, estate, and trust planning, investment management, retirement planning, philanthropic planning |

| WEBSITE | https://advisor.wellington-altus.ca/rosedalefamilyoffice/ |

| ADDRESS | 10 Alcorn Ave Suite 300, Toronto ON M4V 3A9 |

| CONTACT DETAILS | (647) 484-6869 |

| OPERATING HOURS | Monday to Friday: 8:00am-5:00pm |

Rosedale Family Office is a team of what you might call financial gurus. Most of the members are investment advisors and taxation consultants.

RFO is your best option if you have an estate to manage. Though they give individual financial advice, their services are more geared towards families that have to plan for education and philanthropy.

Since they regularly deal with families, you can expect that they can handle unique financial situations and can help you find the proper course of action as your family moves forward financially.

They also have in-house advisors who are more adept at business ventures, though. You’re still covered if that’s your main concern.

The only thing that bothers us about RFO is that they’re tied to the National Bank of Canada, which gives us reason to think that they might push financial products on their clients.

They claim that they only give truly independent objective advice, but it’s up to you to figure out your advisor’s true motives.

Pros

- 14 members can handle larger and complex workloads

- Seamless transition from personal to business finance

- 100+ years of combined experience

Cons

- Customer service could be better

Customer Reviews

Take a look at what Rosedale Family Office clients have to say about their services:

“Working with the team, Rocky/Tasha/Adam & Jesse has been a great experience. They provided my family with a full financial blueprint that includes tax & estate planning. A full service firm that does not take a one size fits all approach & is highly creative.”

– Miranda Tawfik

“After in-depth research and having met with numerous financial advisors when I moved to Toronto three years ago, I finally met with Rocky. I’ve never felt this comfortable being a female investing in the stock market. The level of service and education he provides is above and beyond. I’ve never received such personal service from a financial advisor before. If you’re looking for someone who is relatable, patient, and passionate about his work and genuinely cares about helping you, I highly recommend Rosedale Family Office. I will be a client for the long run.”

– Miranda Popen

10. Kismet Wealth Group Corp.

| SERVICES | Wealth management, real estate & development, mortgages & financing, tax filing & bookkeeping |

| WEBSITE | https://kismetgroup.ca/ |

| ADDRESS | 145 Front Street East Suite 107, Toronto ON M5A 1E1 |

| CONTACT DETAILS | 1-855-683-4381 [email protected] |

| OPERATING HOURS | Monday to Friday: 9:00am-9:00pm |

If you’re in the big leagues, then you’re probably looking for all-encompassing financial advice in the form of wealth management. Affluent folk usually go for a more holistic approach when it comes to their assets, which is what Kismet can provide.

First, the team assesses their clients’ aspirations and maps out how they can be achieved. Implementations and revisions will then be monitored during the ongoing management.

If you’re a high-net-worth individual and you plan on going with KWG, you’ll have the benefit of being able to check your financial status at all times. They have a client portal where you can oversee your plans and get in touch with your advisors.

It’s common knowledge that the affluent rarely ever handle their taxes. Such a job falls on groups like KWG that can file taxes, manage payroll, and prepare financial statements.

More than that, KWG focuses on increasing wealth and have, well, a wealth of experience in that area. It’s worth noting that Kismet retains 95% of their clients, a real testament to the quality of their services.

Pros

- Best for high-net-worth families, medical & legal professionals, entrepreneurs

- Client portal

- Has in-house real estate team

Cons

- No flat rate

11. Parkhouse Financial

| SERVICES | Investments, insurance, tax-efficient solutions |

| WEBSITE | http://www.parkhousefinancial.ca/ |

| ADDRESS | 121 Richmond St W #501, Toronto ON M5H 2K1 |

| CONTACT DETAILS | (416) 838-3617 |

| OPERATING HOURS | Monday to Friday: 9:00am-4:30pm |

If investing is your #1 priority, Nathan Parkhouse is one of the best chartered investment managers around. He can plan your financial future around chosen investments, considering risks, returns, reporting, and fees.

If you sign on with him, you can expect to be sent consolidated statements four times a year, so you can keep an eye on how your investments are going. Most investors can’t be passive about what they spend on investments, so it’s crucial to receive these updates.

Parkhouse Financial also considers life insurance an investment. Permanent life insurance policies are treated as assets with the purpose of diversifying your balance sheet.

If you already have a nice nest egg going, you can also choose to optimize your wealth by using Nathan’s tax-efficient solutions. We appreciate the option to invest extra income in GICs, so your heirs and favorite charities are covered.

Overall, we find that Parkhouse Financial is a no-frills financial planning service for those who want to adapt to future market changes. They even have a portal so you can check your portfolio at any time.

Pros

- Online portal

- Investment slant

- 30+ years of experience

Cons

- Outsources jobs to accountants, lawyers, and mortgage advisors

Customer Reviews

Take a look at what these two Parkhouse Financial clients have to say about Nathan’s services:

“We have been working with Nathan for longer than 5 years now, and we’ve found him and his team to be top notch. They provide well thought out advice on both the strategy and investing levels and are always very quick to respond to any comments, questions, or concerns sent their way. I would highly recommend them to anyone looking for a solid, reliable investment team. Thank you Nathan and gang!”

– Attilio Commisso

“Nathan has been our Financial Planner now for the past 6 years and his advice and service has been amazing. He is constantly in touch with my wife and I both regarding our investments and with current market trends. I have referred him to both family and friends and will continue to do so as I have only heard good things back.”

– Michael Sugar

12. Kind Wealth

| SERVICES | Financial planning, advice meetings, portfolio check-up, investment consultations |

| WEBSITE | https://kindwealth.ca/ |

| ADDRESS | 2 Prennan Ave, Etobicoke ON M9B 4B6 |

| CONTACT DETAILS | (289) 812-9912 [email protected] |

| OPERATING HOURS | Monday to Friday: 9:00am-9:00pm |

Kind Wealth has to be commended for their transparency. All of their services are set at fixed prices, something truly noteworthy if you’re concerned about some firm siphoning hidden fees from your accounts.

KW’s hourly rate is $249 for financial advice meetings, something you can set up if you want to discuss your most pressing financial issues. For an additional $50+HST, you can get a follow-up summary report that you can refer to when you’re ready to make your next financial move.

Do you also have an investment portfolio that needs checking out? KW can run a quick diagnostic on your IP to see if you’re taking on appropriate risks and using the right account types.

If you discover that you’re into what KW is all about, you can have them on a monthly retainer for only $149-$299. That’s inclusive of a comprehensive financial plan with follow-through!

It looks like KW is staying true to their name in that they’re taking an honest and compassionate approach to educating people about their finances. If you want to check them out further, they have a podcast under the same name.

Pros

- Flat rates with no hidden fees

- No commissions

- Free initial consultation (for financial planning)

Cons

- Only two in-house CFPs

Customer Reviews

Here’s proof that Kind Wealth is really out here trying to do some good:

“I had a very good experience with Kind Wealth. David took his time with me and answered all my questions. Some institutions give quite generic answers to financial questions, however David provided a very personalized experience.”

– Colin R

“We’ve been using this service for 2 years now. They have taken a holistic approach to our financial well being and have helped us ensure that we have considered every aspect. Our Planner, Shay, has been outstanding – not only is she extremely knowledgeable, but she has terrific empathy. We’ve felt that she really wants to understand who we are, what we’re all about, and hence see the big picture of our financial needs. She provides us with impartial advice – so very rare, to have advice that you can trust because she’s not receiving commissions, kick-backs, or incentives. She works for us, and provides advice that’s best for us. We highly recommend Kind Wealth to anyone who wants to take control of their financial ecosystem and feel confident that they have a plan.”

– Justyn Szymczyk

How to Choose the Right Financial Planner

Now that you have the best options for financial planning, let’s delve into how you can pick the right one to map out your financial future.

1. Know the areas of financial life that you need help with.

Decide which areas of your financial life require assistance before speaking with a financial planner. You should be prepared to describe your specific money management needs at your first meeting.

It’s important to remember that financial planners offer more than simply investment advice. The right financial planner will be able to assist you in charting a route for all of your financial requirements.

2. Learn about how they make money.

There is no federal legislation that governs who can use the title of financial planner or offer financial advice. While many people claim to be financial planners, not all of them are looking out for your best interests.

Regardless of the planner you pick, be sure you understand how they make money. This allows you to assess if their suggestions are best for you—or for their pockets.

3. Choose the services that you want.

You could need anything from investment advice to debt management. It won’t be the smartest move to avail of a package if it offers more than what you need.

Make sure the financial planner you choose provides the services you require in both your financial and non-financial lives.

4. Decide what you can afford.

Not too long ago, financial planners charged a portion of the assets they managed for you as a fee. Planners now provide a range of pricing arrangements, making their services more affordable to customers of different financial backgrounds.

You could opt for advice-only and fee-based planners who can accommodate your financial restrictions. After all, not only the wealthiest should benefit from their services.

FAQs about Financial Planners

We hope this list helps you secure your financial future. Our picks for the best financial planners in Toronto have seen it all, so all of them can accommodate your unique financial situation.

If you decide to go for a more DIY approach in managing your finances, this list of the best accountants in Toronto is worth checking out too.